Optimise revenue streams and upsell services and amenities with in-app payments enabled on the Chainels platform.

Enhance profitability with in-app payments.

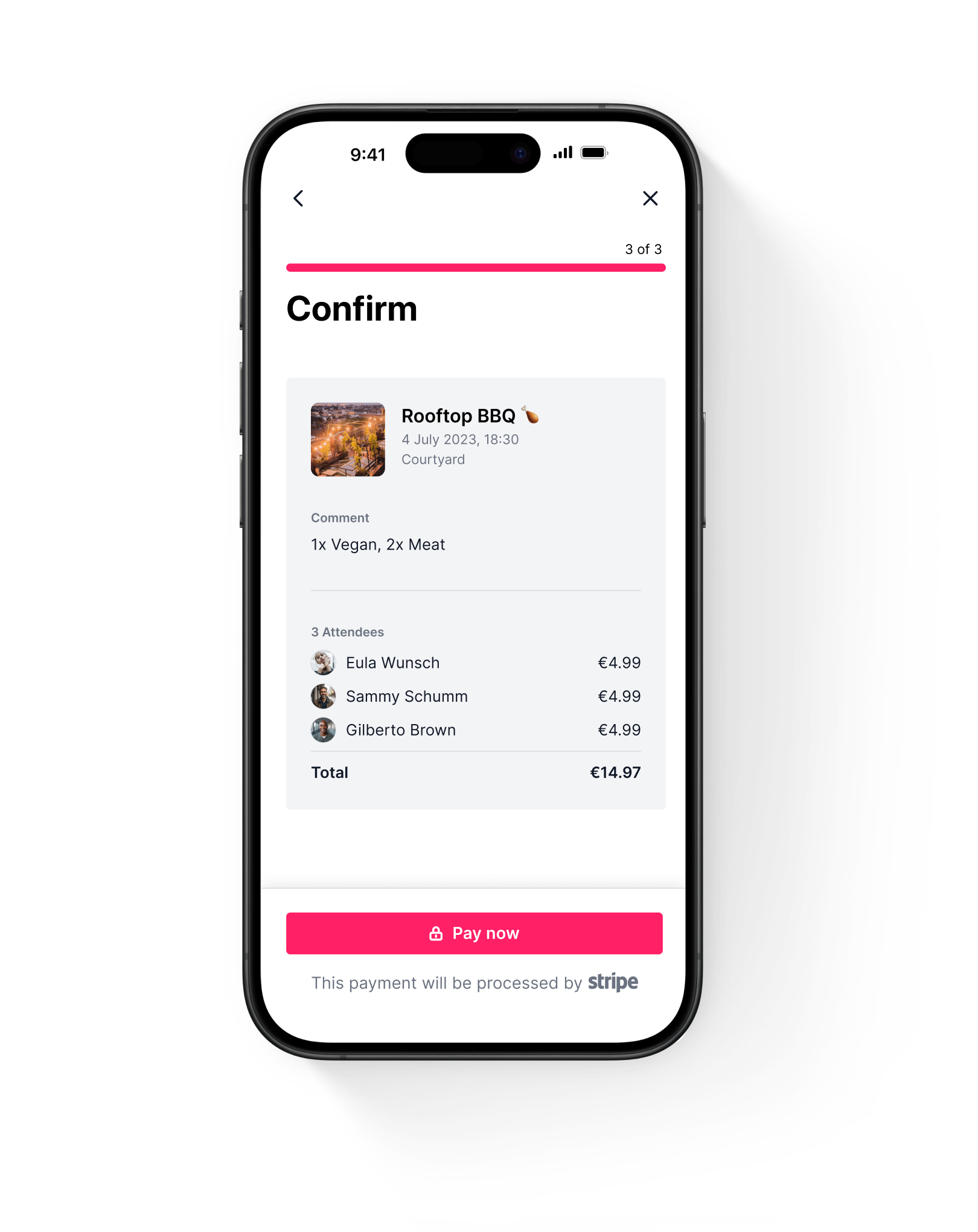

- Collect fees for events and bookings directly from end-users.

- Accept credit and debit card payments, as well as transactions through PayPal, Apple Pay and more.

- Enjoy secure transaction from Stripe's best-in-class, PCI complaint payments platform.

- Save overhead costs with cashless payments available directly within Chainels platform.

- Track and categorise payments through Stripe's advanced dashboard.

- Create promo codes as incentives for tenants to use product and services.

About Stripe

Stripe is a financial technology company that provides online payment processing for businesses. They offer a range of services, including payment gateway solutions, subscription management, and a developer-friendly platform to enable businesses to accept and manage online transactions securely. Stripe's tools and APIs allow customization and integration for various e-commerce needs, making it easier for businesses to handle payments, subscriptions, and financial operations online.

Frequently asked questions

What data or information will be exchanged between Chainels and Stripe

The only data that Chainels sends to Stripe is basic user information like name and email. Details like billing details, payment method et cetera are shared with Stripe by the user at checkout.

How will data security and privacy be addressed in the integration?

Stripe employs several methods to ensure secure payments:

-

Encryption: They use secure encryption protocols to protect sensitive information during transmission. This prevents unauthorized access to data while it's being sent over networks.

-

Tokenization: Instead of storing raw payment data, Stripe tokenizes sensitive information. This means that actual card numbers or payment details aren't stored on their servers. Instead, they use tokens that represent this information, adding an extra layer of security.

-

Strict Security Standards: Stripe complies with strict security standards, including PCI DSS (Payment Card Industry Data Security Standard) compliance. This ensures that they meet industry guidelines for handling cardholder data securely.

-

Two-Factor Authentication (2FA): For added security, Stripe allows merchants to enable two-factor authentication. This requires users to provide two forms of identification before accessing their accounts or making certain transactions.

-

Fraud Prevention Tools: They offer machine learning algorithms and fraud detection tools to identify and prevent fraudulent transactions. These tools analyze patterns and behaviors to flag potentially suspicious activities.

-

Regular Security Audits: Stripe conducts regular security audits and assessments to identify vulnerabilities and ensure their systems remain up to date with the latest security measures.

What are the anticipated costs associated with developing, deploying, and maintaining this integration?

You'll need a Stripe account—consider starting with the free package. Additionally, there are transaction fees from both Stripe and Chainels, which vary based on chosen payment methods.