Turnover rent is a term you might have heard recently, especially since the pandemic.

But what is it, and what does it mean for you and your commercial tenants? Read on to find out.

What is turnover rent?

Turnover rent is a variable rent price based on the performance of a commercial tenant. It’s usually added to a base rent capped at a discounted market rate.

Although nothing new, turnover rent became a key talking point during the coronavirus pandemic. Businesses across the world struggled to pay their rent as physical commerce temporarily ceased.

In a survey by Colliers, 40% of landlords said they’re more likely to consider trading turnover as a key factor when determining rents.

Who benefits from turnover rent?

Both tenants and landlords stand to benefit from turnover rent, provided it’s applied to the appropriate asset type. It’s better suited to established, mall-based retail businesses than to medium-sized, independent high street enterprises.

At first glance, sharing the rent burden with tenants may seem less profitable for landlords than simply asking for fixed rent and ensuring income each month.

However if businesses can continue trading during downturns without having to worry as much about rent, it could pay off in the form of higher lifetime value and tenant retention.

Moreover, in times of upturns, landlords can make more from rent than they otherwise would have with a fixed rent model.

How do you calculate turnover rent?

There are two ways landlords can calculate and charge turnover rent. Of course, landlords decide for themselves what percentage of turnover would be included in the rent, and that will decide how turnover rent is calculated.

Rent payable

The first option is to base turnover rent on the amount that the percentage of gross sales exceeds the rent payable for that year.

You can break it down like this:

Turnover percentage - 10%

Annual rent payable - €100.000

Annual gross sales = €1.300.000

Turnover rent calculation = 1.300.000 x 10% = € 130.000

Turnover rent = € 30.000

.jpg?width=1200&height=399&name=breakdown%20infographic%20-%201%20(2).jpg)

Natural threshold

The second option is to charge turnover rent as the amount that the percentage of gross sales exceeds a natural threshold.

Turnover percentage - 10%

Annual rent payable (base rent) - €100.000

Natural threshold calculation = €100.000/0,10

Natural threshold = €1.000.000

Annual gross sales - €1.300.000

Variance - 300.000 x 0,10

Turnover rent = 30.000

How can tenants report their turnover?

Many commercial tenants report their turnover through spreadsheets or email. These are standard, ‘traditional’ methods, but they’re also error prone and time-consuming.

Moreover, many tenants may not remember to report their turnover on time, which can render a turnover rent model unworkable.

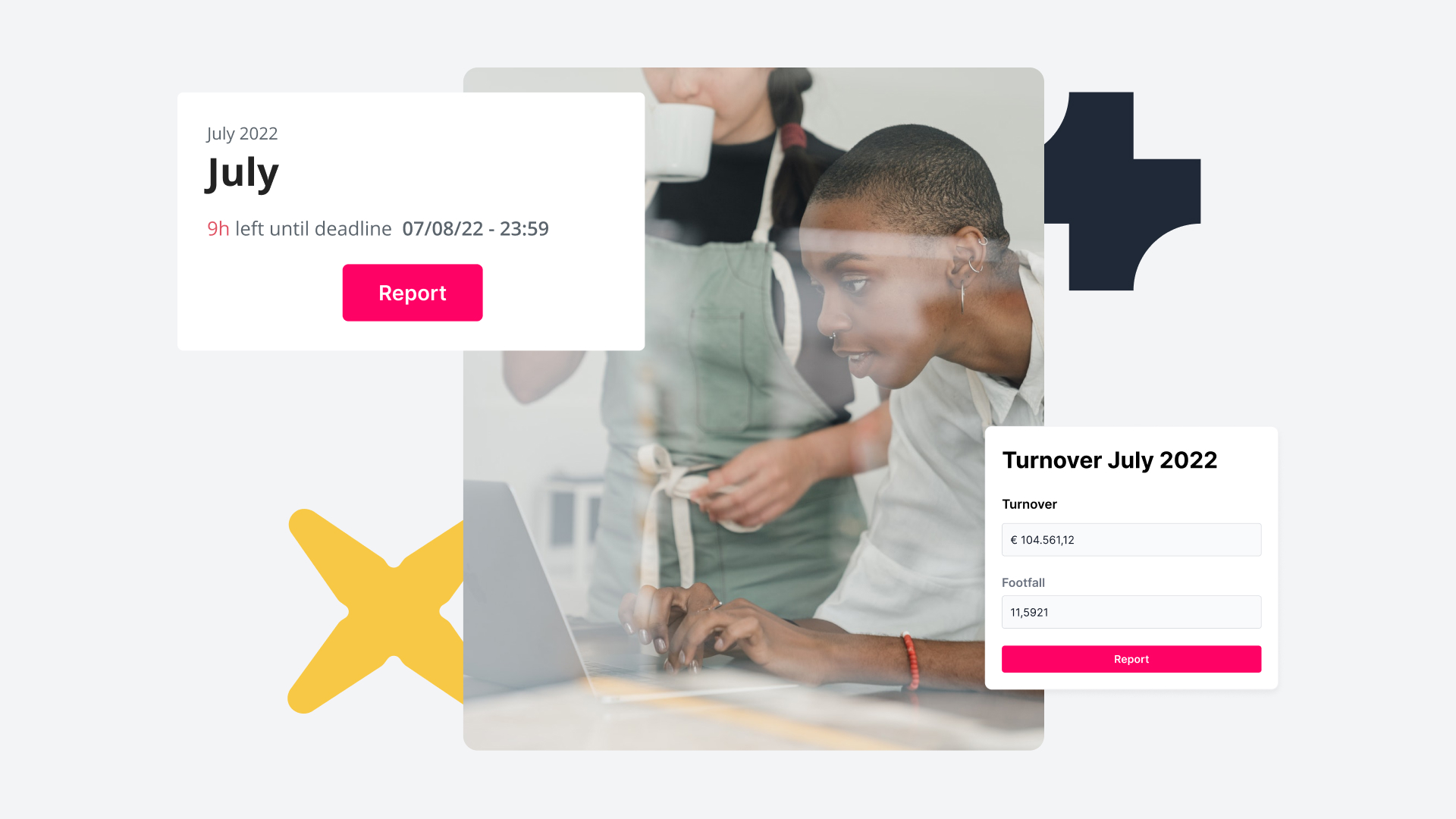

With a tenant communication platform like Chainels, you can enable simple and timely turnover reporting. Chainels makes it easier to keep track of tenants who are behind schedule, send reminders, and request additional fiscal documents (e.g. accounting documents or balance sheets) to ensure that turnover rents are accurate, as well as request extra KPIs like average basket size.

Let us help you centralise your turnover reporting

How does it do this? By providing a listed overview of all the businesses within your retail property alongside the following data:

- Whether they’ve already reported their turnover for a selected timeframe

- If they’re yet to report it, and how many days they have left before the predefined deadline.

- If they’ve already reported it, the monetary value of their turnover, plus any growth or decline from the previous month, quarter or year.

From the reports dashboard, managers can also send automatic reminders based on predefined timeframes, and select a custom timeframe for automatic reminders. They can also request additional documents.

Pros and cons of a turnover rent model

Pros

- An income based on turnover is better than no income from tenants going out of business.

- Turnover rent provides commercial tenants with a degree of flexibility, which can lead to higher satisfaction and retention.

- Both tenants and landlords and reap the rewards of booms in trading

Cons

- Turnover rent risks being miscalculated, making the percentage too high or the threshold too low. This is often the result of inconsistent reporting practices.

- Turnover reports can be wrong, leading to inaccurate rents (however, this can be alleviated through apps like Chainels that facilitate better document management).

- Both tenant and landlord share risk.

- It could be harder to convince a tenant experiencing consistently high turnover to share a percentage with their landlord.

Is turnover rent right for your portfolio?

Turnover rent may not be right for everyone, but it may provide tenants in your portfolio the flexibility they need to carry on leasing from you.

Chainels can make things much easier for both you and your tenants.